COVID-19’s Evolving Impacts on the Analytics Community: Industries, Regions, and More

Back in March as lockdowns began to spread nationwide, we began several research initiatives to track the impact of the COVID-19 pandemic on the data science and analytics community, and to bring current, helpful information to the candidates, clients, students, and professors in our extended network.What follows is a summary of some of the data we were able to collect and share, but additional information about all of these projects are tagged on our blog here.

1. Measuring the Impact of COVID-19 to the Analytics Community: March-May 2020

When it became apparent that the effects of COVID-19 on analytics teams were likely to be substantial, we collaborated with the International Institute for Analytics (IIA) to field a joint survey over the course of several months to determine how many teams were being impacted, as well as the most common effects to workload, staffing & hiring, and use of analytics to address the crisis.

Staffing & Hiring Impacts

By the end of May, the number of companies with staffing impacts had nearly tripled over the prior two months to 53.4%. It is also perhaps not surprising that large companies were weathering the storm a bit better than small companies.When we asked what types of staffing actions had been taken in cases where there was action, by far the most prevalent action was some form of salary cuts, with nearly 80% of impacted analytics and data science organizations experiencing salary cuts. Furloughs (16%) and layoffs (32%) were less common, which is encouraging since those actions are more extreme.

Impact to Analytics Workload & Use of Analytics to Address the Crisis

Another high point is that while nearly 75% of organizations were pulled into crisis-oriented analytics, by the end of May there were very few in a pure panic mode where everything was focused on the crisis (1.1%).While 18.2% of organizations reported that decisions were being forced so quickly that there was no opportunity to use proper analytics to address them, the fact that 45% of organizations were keeping analytics front and center could be part of the reason why layoffs and furloughs were the exception for analytics teams. Being critical to navigating the crisis may help to insulate analytics teams. We’re continue to see many data scientists and analytics professionals being pulled into projects related to COVID-19 since their skills are well suited to tracking and predicting trends related to the pandemic’s increasing impact.

2. Measuring Ongoing Hiring Impacts, WFH Strategies, and Employee Sentiment: July 2020

As the results from our initial survey seemed to indicate that the worst impacts may be behind us, we published results from our Analytics Impact Survey 2.0 to address new questions, including shifts in the market, and to address the topics we continued to be asked about the most: hiring/layoffs, job/business security, and work from home timelines.With over 300 responses, we were also able to further examine how responses varied by job level, region, and industry category. Although this data is now six weeks old so things may have changed, we’ve shared a few insights below that seem to match up with what we’ve been hearing in our conversations with candidates and clients over the past several months.

Status of Hiring/Staffing Impact

Overall

When asked to give an update on what best describes their team’s current status regarding their hiring, we found that 7.6% of data scientists and analytics professionals reported their team actually increased hiring due to the COVID-19 crisis. While 42.1% reported no impact in terms of salary cuts, hiring freezes, layoffs, or furloughs, 35.7% of respondents said their team had been impacted by at least one of these options, and 14.5% said there were still rumors or plans of additional cuts on the way.

We also examined how these responses varied by industry and region.

Industry

We found that firms in Pharmaceuticals, Medical Insurers, Medical Devices, Finance, Banking, and Insurance have so far been the least impacted in terms of their hiring and staffing. In fact, more firms in these categories have continued to hire throughout the pandemic.Marketing and advertising firms have been the most negatively impacted, and many professionals believe that more cutbacks are still on the way.

Region

Those in the Northeast seem to have experienced the fewest changes to their staffing and hiring as a result of COVID-19, and in this region there are also the fewest rumors about future cutbacks.

Work from Home Strategies

When we’d surveyed our database in May, we discovered that nearly everyone at that point was working from home. By July, as more data science & analytics teams were looking to address the question of if or when to reopen the office, and how to do so, we felt this would be an interesting topic to ask about in our new survey.We found that 15.4% of respondents were already working from home before the crisis, with an additional 3.7% that have now been moved to permanently working from home. While a small percentage (3.7%) reported already being back in the office, 19.7% said they were planning to return at some point before the end of the year. Just over a quarter (25.4%) reported that they were planning to return sometime in 2021, while the largest portion (28.2%) said that plans were still undecided.

Employee Sentiment: Personal vs. Business Stability

Overall

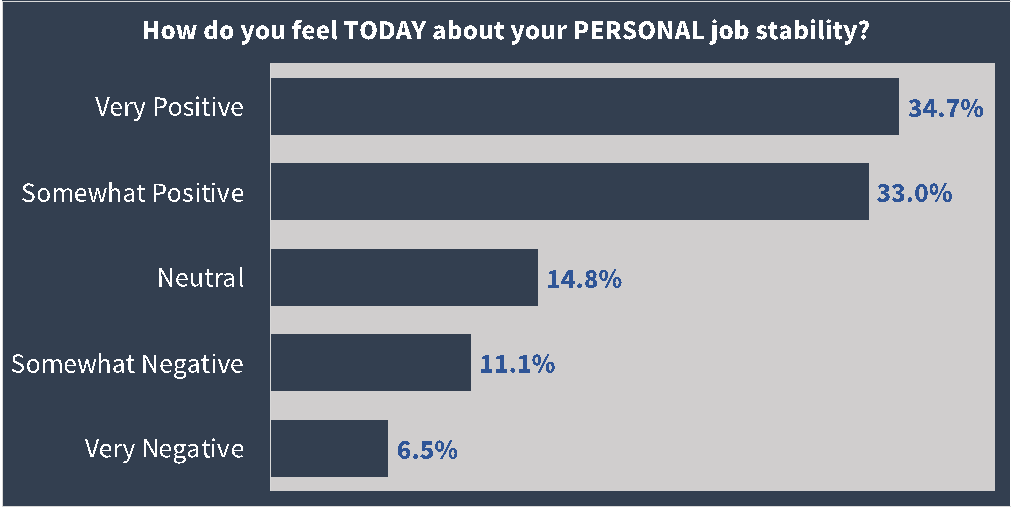

Our last question aimed to determine whether employees felt generally positive, negative, or neutral, both about their personal job stability and their company’s business stability. The results lined up relatively closely – employees generally felt the same sentiment about both aspects rather than a mix. We found 67.7% of respondents feeling positive about their personal situation, and 64.4% feeling positive about their company’s business situation. In terms of negative sentiment, 17.6% of respondents reported feeling negative about their personal stability and 18.2% felt negatively about their company’s stability.

We also examined how these responses varied by industry, region, and compared individual contributor responses vs. managers.

Industry

Those in Pharmaceuticals, Medical Insurance, and Medical Devices felt the most positive about their company stability, followed by those in Finance, Banking, and Insurance. This makes sense given that these categories were also the least likely to be negatively impacted by the pandemic in terms of staffing and hiring (so far). Those in Consulting felt the most negatively about their company’s stability.

Region

West Coast individuals are more positive about their company’s business stability than their personal job stability, whereas in all other regions, individuals seemed more positive about their personal situation. Although it is not a huge difference, the disparity is noticeable.

Individual Contributors vs. Managers

Individual contributors felt more positive about their personal job stability than their company’s business stability. However, in regards to both company and personal stability, individual contributors had a more negative outlook than managers.Want to learn more about developing job market trends and how data scientists and analytics professionals may continue to be impacted? Check out our post on 2020 trends (and beyond) here.